#quickbooks connectivity tool

Explore tagged Tumblr posts

Text

The Role of Technology in Outsourcing Bookkeeping: How Assist Bay Uses Modern Tools for Seamless Integration

In today’s globalized economy, outsourcing bookkeeping services has become a strategic solution for businesses looking to streamline operations, reduce overhead costs, and improve efficiency. Particularly in the UK and the Caribbean, companies are increasingly outsourcing their accounting needs to offshore experts in India. At the heart of this transformation lies the role of technology, which has revolutionized the way businesses integrate with outsourced bookkeeping services. Assist Bay, a leader in providing outsourced bookkeeping solutions, is harnessing modern tools to make this process seamless, efficient, and transparent.

The Growing Trend of Bookkeeping Outsourcing

Outsourcing bookkeeping services is a growing trend, especially in the UK and the Caribbean, where businesses are constantly seeking ways to reduce operational costs while maintaining high-quality financial management. Many businesses in these regions, especially small to medium-sized enterprises (SMEs), are turning to offshore solutions like those provided by Assist Bay, which is based in India. Outsourcing bookkeeping not only allows companies to access skilled accounting professionals at a fraction of the cost but also ensures that businesses can focus on their core activities while maintaining financial accuracy and compliance with local tax laws.

Why India for Outsourcing Bookkeeping?

India has long been a go-to destination for outsourcing services due to its large pool of skilled professionals, a robust IT infrastructure, and cost-efficiency. Indian bookkeeping experts are well-versed in international accounting standards, including UK GAAP (Generally Accepted Accounting Principles) and Caribbean tax laws, making them a perfect fit for businesses in the UK and the Caribbean.

The Role of Technology in Bookkeeping Outsourcing

As the landscape of outsourcing evolves, so does the technology that supports it. At Assist Bay, modern tools play a crucial role in making bookkeeping outsourcing seamless. Here’s how technology is transforming the process.

Cloud-Based Bookkeeping Software

One of the biggest advancements in the bookkeeping industry has been the shift to cloud-based platforms. Tools like QuickBooks, Xero, and Zoho Books allow real-time access to financial data from anywhere in the world. This enables business owners in the UK and the Caribbean to collaborate effectively with their offshore bookkeeping teams in India. Cloud-based software ensures that all financial data is stored securely, and updates can be made in real-time, reducing the risk of errors. Whether it’s invoicing, payroll, or tax filing, cloud-based bookkeeping tools ensure that everything is up-to-date and accurate.

2. Automation of Repetitive Tasks

Another significant way technology has improved bookkeeping outsourcing is through automation. At Assist Bay, advanced automation tools are used to manage repetitive tasks such as data entry, transaction categorization, and reconciliation. This reduces human error, saves time, and ensures that the team can focus on more strategic tasks, like financial analysis and forecasting. By automating these routine tasks, businesses in the UK and Caribbean can rely on fast, accurate, and consistent bookkeeping services without the worry of manual errors creeping in.

3. Integration with Financial Systems

One of the key benefits of outsourcing bookkeeping to India is the seamless integration with a company’s existing financial systems. Modern tools allow for smooth integration with platforms like ERP systems, CRMs, and other financial applications. Assist Bay leverages APIs (Application Programming Interfaces) to connect various software tools, ensuring that data flows effortlessly between systems. This integration ensures that businesses don’t have to deal with fragmented information. They can access consolidated financial data, reports, and analytics from one central location, making decision-making more efficient and informed.

4. Data Security and Compliance

Data security and compliance are top concerns for businesses when outsourcing their bookkeeping. In the UK and the Caribbean, businesses need to ensure that their financial data is protected and compliant with local regulations. Assist Bay employs the latest encryption technologies to safeguard sensitive financial information, ensuring that only authorized personnel have access. Moreover, Assist Bay stays up-to-date with changes in tax laws and accounting standards, ensuring that all bookkeeping practices meet local regulatory requirements. For businesses in the UK, this means adhering to HMRC standards, while for companies in the Caribbean, it involves compliance with local tax laws, which can differ from one island to another.

5. Real-Time Collaboration and Communication Tools

Technology has also improved communication between outsourced bookkeeping teams and businesses. Assist Bay uses collaborative tools like Slack, Microsoft Teams, and Zoom to ensure constant communication and immediate resolution of any issues. This ensures that clients in the UK and the Caribbean are always in the loop and can easily discuss any concerns with their bookkeeping team. Real-time communication tools also allow for faster decision-making and better collaboration on financial reports and business strategies. As a result, businesses can stay agile and responsive in today’s competitive environment.

6. Data Analytics and Reporting

Gone are the days of manual ledger entry and paper-based reporting. With the help of modern tools, Assist Bay provides businesses in the UK and Caribbean with detailed financial analytics and real-time reports. By analysing financial data with AI-powered tools, Assist Bay helps businesses gain valuable insights into their spending habits, cash flow, and profitability. These reports can be customized to suit the specific needs of a business, giving stakeholders the information they need to make informed decisions. Whether it’s forecasting revenue, tracking expenses, or assessing tax liabilities, data-driven insights are now more accessible than ever before.

The Future of Bookkeeping Outsourcing

The future of bookkeeping outsourcing lies in the continued evolution of technology. As cloud computing, automation, and AI become more advanced, the role of technology in outsourcing will only grow. Assist Bay is at the forefront of this change, helping businesses in the UK and the Caribbean seamlessly integrate outsourced bookkeeping services with modern technology. By leveraging cutting-edge tools and maintaining a focus on security, accuracy, and compliance, Assist Bay ensures that businesses can confidently rely on outsourced bookkeeping services without compromising on quality. As the demand for outsourcing grows, businesses in the UK, Caribbean, and beyond will continue to benefit from the efficiency, cost savings, and strategic insights that modern technology offers. Outsourcing bookkeeping services to India is no longer just about saving costs — it’s about gaining a competitive advantage by leveraging the power of technology for smarter, more efficient financial management.

2 notes

·

View notes

Text

Expert Power Platform Services | Navignite LLP

Looking to streamline your business processes with custom applications? With over 10 years of extensive experience, our agency specializes in delivering top-notch Power Apps services that transform the way you operate. We harness the full potential of the Microsoft Power Platform to create solutions that are tailored to your unique needs.

Our Services Include:

Custom Power Apps Development: Building bespoke applications to address your specific business challenges.

Workflow Automation with Power Automate: Enhancing efficiency through automated workflows and processes.

Integration with Microsoft Suite: Seamless connectivity with SharePoint, Dynamics 365, Power BI, and other Microsoft tools.

Third-Party Integrations: Expertise in integrating Xero, QuickBooks, MYOB, and other external systems.

Data Migration & Management: Secure and efficient data handling using tools like XRM Toolbox.

Maintenance & Support: Ongoing support to ensure your applications run smoothly and effectively.

Our decade-long experience includes working with technologies like Azure Functions, Custom Web Services, and SQL Server, ensuring that we deliver robust and scalable solutions.

Why Choose Us?

Proven Expertise: Over 10 years of experience in Microsoft Dynamics CRM and Power Platform.

Tailored Solutions: Customized services that align with your business goals.

Comprehensive Skill Set: Proficient in plugin development, workflow management, and client-side scripting.

Client-Centric Approach: Dedicated to improving your productivity and simplifying tasks.

Boost your productivity and drive innovation with our expert Power Apps solutions.

Contact us today to elevate your business to the next level!

#artificial intelligence#power platform#microsoft power apps#microsoft power platform#powerplatform#power platform developers#microsoft power platform developer#msft power platform#dynamics 365 platform

2 notes

·

View notes

Text

Navigating Real-Time Operations: The Power of Operational Dashboards

Operational dashboards are dynamic visual interfaces that provide real-time insights into an organization's day-to-day activities and performance. These dashboards are particularly valuable for monitoring short-term operations at lower managerial levels, and they find application across various departments. They stand as the most prevalent tools in the realm of business intelligence.

Typically, operational dashboards are characterized by their comprehensive nature, offering junior managers detailed information necessary to respond to market dynamics promptly. They also serve to alert upper management about emerging trends or issues before they escalate. These dashboards primarily cater to the needs of managers and supervisors, enabling them to oversee ongoing activities and make rapid decisions based on the presented information. Operational dashboards often employ graphical representations like graphs, charts, and tables and can be customized to display information pertinent to the specific user.

Examples of data typically showcased on an operational dashboard include:

Sales figures

Production metrics

Inventory levels

Service levels

Employee performance metrics

Machine or equipment performance data

Customer service metrics

Website or social media analytics

It is crucial to emphasize that operational dashboards are distinct from other dashboard types, such as strategic and analytical dashboards. These different dashboards serve varied purposes and audiences and contain dissimilar datasets and metrics. Here are a couple of examples.

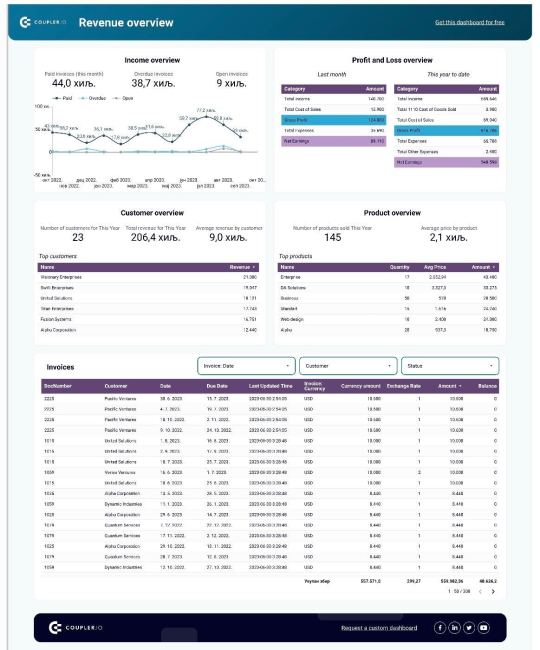

Below, you can see a Revenue overview dashboard for QuickBooks. It provides month-by-month overviews of invoices, products, customers, profit and loss. Such a dashboard can be used on a daily basis and help monitor and manage operating activities.

This data visualization is connected to a data automation solution, Coupler.io. It automatically transfers fresh data from QuickBooks to the dashboard, making it auto-updating. Such a live dashboard can be an important instrument for enabling informed decision-making.

This Revenue overview dashboard is available as a free template. Open it and check the Readme tab to see how to use it.

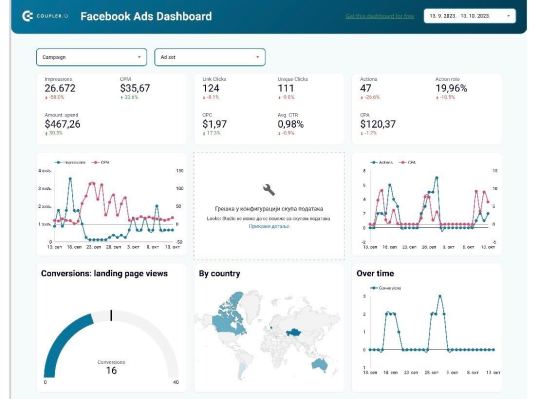

Here’s another example of an operational dashboard, the Facebook Ads dashboard. It allows ad managers to closely track their ad performance. This dashboard is also powered by Coupler.io, so it depicts ad data in near real-time. This allows marketers to quickly define what works and what doesn’t and make adjustments on the go.

Facebook Ads dashboard is available as a free template. You can grab it and quickly get a copy of this dashboard with your data. In conclusion, operational dashboards are indispensable tools for organizations seeking to thrive in a dynamic business landscape. These real-time visual displays offer invaluable insights into day-to-day operations, equipping managers and supervisors with the information to make swift, informed decisions. As the most widely used business intelligence instruments, operational dashboards empower businesses to adapt to market changes, identify emerging trends, and maintain a competitive edge. Their versatility and capacity to monitor a wide range of metrics make them an essential asset for managing the intricacies of modern operations.

#marketing dashboards#digital marketing#dashboards#data analytics#data visualization#operational dashboards

2 notes

·

View notes

Text

5 Security Tips for Accountants Who Work Online

Like any other digital profession, accounting work is also prone to security threats. You never know who’s watching when you work online—whether you’re reviewing payroll, filing taxes, or accessing bank records.

The tools you use are powerful, but they’re not bulletproof. Even a single careless login, outdated system, or unsecured password can open the door to data theft.

If you manage accounts online, security isn’t a nice-to-have—it’s a responsibility. So, let us give you 5 tips to help you keep your work, your clients, and your reputation safe.

Why Does Security Matter for Accountants Who Work Online?

If you’re an accountant, you must know how to handle more than mere calculations. You have to manage confidential records—bank details, tax filings, payrolls, and business ledgers. Right? That data is valuable. If stolen, it can lead to identity theft, fraud, or financial loss.

It’s also very clear that cybercriminals often target small firms, freelancers, and even individual accountants. They assume basic security mistakes—like weak passwords or unchecked access—will let them in.

See, online tools make work faster, but every connection you open adds risk. One exposed account can compromise dozens of client files. One leaked password can open access to banking platforms. Most breaches don’t happen through high-level hacking. They happen through ignored updates, reused passwords, and careless clicks.

So, security matters because you work with trust. If clients feel exposed, they walk away. If data leaks, your reputation suffers—even if recovery is possible.

A secure system shows control. It proves that your practice is professional, reliable, and ready to grow in the digital age.

What Security Tips Should Accountants Follow?

Use Two-Factor Authentication on Every Account You Log Into Passwords are easy to steal. Phishing, leaked databases, or weak combinations can expose your login in seconds. Two-factor authentication (2FA) adds one more step that attackers cannot bypass.

When 2FA is active, logging in requires two things:

Your password

A second code sent to your phone or generated by an app

Even if someone knows your password, they cannot get in without that second code.

You should turn on 2FA for all work accounts:

Email

Cloud storage

Accounting platforms

Bank logins

The majority of tools support 2FA through SMS or apps like Google Authenticator. It takes only a few minutes to enable it, and if you ignore it, you’ll leave the door open to cybersecurity threats.

Update Your Software Regularly to Close Security Gaps

Outdated software becomes an easy target. Hackers look for known flaws in older versions of apps, operating systems, and plugins. Sometimes, when a company discovers a vulnerability, it releases a patch. If you delay the update, you stay exposed.

You should always keep the following up to date:

Operating systems (Windows, macOS)

Accounting software (QuickBooks, Xero)

Browsers and extensions

Antivirus and firewall tools

See, attacks don’t always break new ground. They hit users who skip updates. So, staying current blocks the attacks before they start.

Check Your IP Location History to Detect Suspicious Logins

Every time you log into a service, your device uses an IP address. That IP shows your IP location—the city, region, or country of the request.

You can review that login history on many platforms:

Google and Microsoft accounts

Cloud storage dashboards

Some accounting software with activity logs

If you see a login from a place you’ve never visited, it signals a security breach. Even if the login was successful, you should change your password and enable alerts.

Track your IP location weekly. That habit helps you catch threats early, especially when your credentials are reused without your knowledge.

Use a DNS Lookup Tool Before Trusting Unfamiliar Websites

Scam websites look real. Hackers copy bank portals, tax sites, or accounting dashboards to steal your login. The design may match, but the domain tells the truth.

You should run a DNS lookup before entering credentials on any unfamiliar link because it:

Verifies MX records to ensure client emails are deliverable.

Confirms SPF, DKIM, and DMARC records to prevent spoofing and phishing.

Checks A and AAAA records to validate server IPs for accounting software.

Identifies CNAME records to confirm safe redirects to client portals.

Detects NS records to confirm that domains use trusted name servers.

Spots missing or incorrect DNS entries that could block file sharing or logins.

Helps troubleshoot email issues, server downtimes, and domain misconfigurations.

If the domain was created recently or points to unknown servers, avoid it. Trust only domains linked to verified companies with clear records.

Store Your Passwords in a Secure Password Manager

Passwords stored in documents, emails, or notebooks can be stolen easily. Anyone with access to your device or inbox can find them.

You should use a password manager instead. It keeps all your logins in one encrypted vault. You only need to remember one strong master password.

See, a good password manager:

Encrypts your data locally

Syncs securely across devices

Fills in passwords without exposing them

Avoid browser-based storage without a vault. Choose a dedicated tool with zero-knowledge encryption and backup recovery options. That way, your credentials stay safe—even if your device doesn’t.

What Happens If You Ignore These Security Steps?

You put your clients—and your entire practice—at risk.

No two-factor authentication means anyone who guesses or steals your password can log into your cloud accounting software. They can access balance sheets, tax records, and payroll details without you knowing.

Skip software updates, and you leave your system open to known bugs. A ransomware attack can lock your entire client database, right before tax season.

Ignore your IP location logs, and you might miss a login from another country using your credentials. A hacker could change invoice numbers, redirect payments, or silently download reports while you work on something else. Or merely trust a fake login page without a DNS lookup, and you could enter your bank credentials into a cloned website. Funds disappear. So do transaction records.

Keep client passwords saved in a spreadsheet or email draft, and a single device theft means multiple client accounts get exposed at once. One client might forgive that. Most won’t.

Each mistake alone creates damage. Ignore all five, and you remove every layer of protection. You won’t just lose data—you’ll lose trust, contracts, and possibly your license to operate.

Accountants work with private, high-value data. That’s why online security isn’t optional. It’s basically part of the job.

Bottom Line

Don’t invite risk by skipping 2FA, ignoring updates, overlooking IP logs, trusting unverified sites, or saving passwords insecurely. As an accountant working online, your safety depends on consistency. The smartest tip? Treat security like part of your workflow—not an afterthought.

0 notes

Text

How to Manage a Business Remotely with a Virtual Office in Indore

Running a business no longer means being tied to a physical location. In today’s digital age, entrepreneurs, freelancers, and even full-fledged companies are increasingly turning to virtual offices to maintain flexibility while staying professional.

If you’ve chosen Indore—a fast-growing commercial hub in central India—you’re already on the right track. But how do you effectively manage a business remotely using a virtual office in Indore?

This blog walks you through practical strategies, tools, and tips to ensure your business operates smoothly—even when you’re not physically there.

1. Establish a Solid Communication System

The backbone of any remote business is communication. Just because you don’t have a traditional office doesn’t mean communication should suffer. Here’s how you can stay connected:

🔹 Use Team Collaboration Tools:

Slack for internal chats

Zoom or Google Meet for meetings

Asana or Trello for project tracking

🔹 For Clients:

Set up a dedicated business number

Use tools like Calendly for scheduling

Consider hiring a virtual receptionist via your virtual office provider

With a virtual office in Indore, you can also opt for call forwarding and mail handling services, ensuring you never miss important messages or documents.

2. Build a Documented Workflow

Remote work thrives on clarity. Document your processes so everyone knows what to do and how to do it—even in your absence. Create a central repository (Google Drive or Notion) for:

SOPs (Standard Operating Procedures)

Onboarding documents

Company policies and timelines

This helps eliminate confusion and ensures a consistent experience for both employees and clients.

3. Leverage Virtual Office Services

Most providers of virtual office in Indore offer more than just an address. Make sure you’re using the full range of features to support remote business operations:

Mail collection & forwarding: You’ll get notified when packages or legal notices arrive.

Meeting room access: Book them when you're in town or need face-to-face client discussions.

Document support: Many providers help with GST, ROC compliance, and courier services.

These offerings make it possible to run operations remotely without compromising professionalism.

4. Automate Your Business Processes

Automation saves time and reduces manual errors—especially when your team is remote. Use tools like:

Zapier: Automates workflows between apps

QuickBooks or Zoho Books: For accounting

HubSpot or Freshsales: For customer relationship management

Also consider automating responses for inquiries via chatbots or WhatsApp Business, so your business stays responsive 24/7.

5. Monitor Team Performance Without Micromanaging

Micromanaging is the quickest way to kill productivity and morale—especially remotely. Instead, build a system of accountability and autonomy.

How?

Weekly check-ins or scrums

Clear deadlines and deliverables

Performance dashboards (via tools like ClickUp or Basecamp)

Remote businesses thrive on trust and transparency, and your team will appreciate the freedom if expectations are clearly communicated.

6. Maintain a Local Business Presence

Even if you’re working from another city or country, clients and partners want to feel like your business is accessible. That’s where your virtual office in Indore plays a crucial role.

Use your Indore address for:

Invoices

Websites and social media

Client proposals

Legal documents

This gives your brand a local identity, especially if your target audience is in or around Madhya Pradesh.

7. Keep Compliance and Documentation Updated

Just because you're remote doesn’t mean you can neglect paperwork. Make sure you renew your:

Virtual office rent agreement

GST registration (if applicable)

ROC filings

Choose a provider that sends timely reminders and even assists with renewals or updates.

8. Plan Occasional On-Ground Activities

While remote is efficient, occasional physical interactions can strengthen business relationships. Use your virtual office to:

Host quarterly team meetups

Invite clients for presentations

Conduct interviews or partner discussions

Most Indore-based virtual offices offer flexible hourly or daily access to professional meeting spaces. Use these strategically to maintain a human touch.

9. Offer Flexible Work Models to Employees

One of the perks of remote business is attracting talent from across the country. Create a flexible model where employees:

Can work from home

Have the option to co-work at partner spaces in Indore (check if your virtual office offers this)

Attend monthly in-person strategy sessions

This makes your business adaptable and more appealing to modern professionals.

10. Stay Visible and Market Actively

Don’t let the “virtual” nature of your business make you invisible. Continue to market actively:

Use your Indore location in SEO and listings (e.g., “Consulting firm in Indore”)

Run social media campaigns highlighting your services

Join local directories and forums

Your virtual presence is only as strong as your digital visibility.

Final Thoughts

Running a business remotely is no longer a challenge—it’s an opportunity. And with a virtual office in Indore, you have everything you need to build a trusted, scalable, and professional business without sitting in a cubicle every day.

From local brand presence to legal compliance, mail handling to on-demand workspace access, the right virtual office setup helps you manage your operations smoothly while enjoying the flexibility of working from anywhere.

#VirtualOfficeIndore#RemoteWorkIndia#StartupIndore#WorkFromAnywhere#BusinessTips#FlexibleWorkspaces#EntrepreneurLife

0 notes

Text

Your Perfect Salesforce integration solutions and Services partner

Juggling data across multiple platforms while managing Customer Relationship Management (CRM) can be a real challenge.

We simplify this by offering Salesforce integration services with any third-party application. Our Salesforce

integration solutions enable seamless data flow between your legacy systems and Salesforce, with a wide range of

technologies including SOAP, REST, BULK, Tooling and Metadata Salesforce API integration as well as OData web services.

Whether you’re looking to streamline operations, automate processes or enhance system interoperability, we’ve got you

covered.

We have extensive experience integrating multiple platforms across a wide range of industries. Our Salesforce

integration works include accounting platforms like Xero, QuickBooks, and MYOB; payment gateways such as Stripe, PayPal,

and http://Authorize.Net; and business tools like HubSpot, DocuSign, GoToMeeting, JanRain, Zendesk, Slack, and Drift. We have

also worked with leasing platforms including Autodesk, GreatAmerica, and LEAF, delivering seamless system connections

that improve efficiency and drive business growth.

Let’s Connect: https://www.kandisatech.com/service/integration

#Salesforce Integration Services#Salesforce Integration Solutions#Salesforce Integration Company#salesforce integration services#salesforce managed services#salesforce development services

0 notes

Text

How Oracle HCM Solutions Helped Us Discover What Was Broken in Our Onboarding Process

At first glance, our hiring process at Avion Technology seemed to work just fine. We could attract talent, conduct interviews, and send out offer letters quickly. But as we began to scale, it became clear: our onboarding process had cracks we hadn’t even noticed.

While no single step was “broken,” the system was far from efficient. New hires were left waiting. HR was swamped. IT processes lagged. The result? A disjointed employee experience that impacted productivity and morale.

That’s when we turned to Oracle HCM Solutions—and everything changed.

What Wasn’t Working (That We Didn’t See Coming)

We weren’t short on talent. We were short on tools and structure. Here are just a few friction points we faced:

Paper-based onboarding documents

Manually triggered IT setups

Multiple systems for HR, payroll, and benefits

Repetitive data entry for every new hire

Delays in communication and inconsistent onboarding timelines

Individually, these issues were small. Together, they formed a major bottleneck.

The Shift to Oracle HCM Cloud

Switching to Oracle HCM Solutions was more than a tech upgrade—it was a strategic move. Here's what changed for the better:

Automated workflows drastically reduced onboarding time

E-signature tools removed paper-based delays

Employee self-service portals handled most new hire questions

Integrated systems connected HR, IT, and leadership in real time

The result? Faster onboarding, less HR stress, and a confident start for every employee.

Key Features That Make Oracle HCM Solutions Stand Out

Whether you're leading a mid-sized business or scaling a larger enterprise, Oracle HCM Cloud comes with a full suite of tools that make onboarding and HR management more intelligent:

Core HR: Unified employee records, global compliance

Talent Management: Smart recruiting, goal-setting, and performance tracking

Workforce Rewards: Compensation and benefits tools

Workforce Management: Time tracking, scheduling, leave requests

Employee Experience: Personalized onboarding journeys and AI-powered HR help desks

Analytics & Payroll Integration: Real-time data visibility and predictive insights

Why Hybrid Teams Need HCM More Than Ever

In hybrid and remote work models, smooth onboarding is no longer optional—it’s essential.

Oracle HCM Solutions are built to support distributed teams with:

Remote completion of onboarding tasks

Automated IT and HR coordination

Unified access to company policies, welcome kits, and team intros

Mobile-first design for anytime, anywhere accessibility

Manager dashboards to track onboarding progress

For companies managing multiple locations or remote employees, this centralized approach removes friction and creates consistency.

How We Help Others Do the Same

At Avion Technology, we’re not just users of Oracle HCM—we help other businesses implement it too. Our team offers:

Full implementation and configuration

Custom system integrations (ERP, payroll, CRM)

Workflow automation and employee portals

Post-launch support, training, and optimization

From our base in Schaumburg, Illinois, we help growing businesses across the U.S. modernize their HR and onboarding operations.

Frequently Asked Questions (FAQs)

1. Is Oracle HCM Cloud a good fit for small businesses? It works best for mid-size to large enterprises, especially those with complex workflows or distributed teams.

2. How long does it take to implement? Typical implementation takes 8–16 weeks, depending on customization and modules selected.

3. Can Oracle HCM integrate with payroll or CRM platforms? Yes. It integrates with popular systems like QuickBooks, ADP, and NetSuite.

4. What support is available post-implementation? Ongoing support includes training, user adoption, and continuous system optimization.

5. What makes Oracle HCM ideal for remote teams? Self-service onboarding, mobile access, and cloud-based tools ensure a smooth experience from any location.

Hiring is just the beginning. Let us help you deliver a seamless onboarding experience that retains top talent, boosts productivity, and scales effortlessly.

Get a Free HCM Readiness Assessment Let’s discover what’s slowing your onboarding down—and how Oracle HCM can fix it.

Contact Avion Technology today to get started.

#OracleHCM#HCMsolutions#DigitalOnboarding#HRTech#EmployeeExperience#HRTransformation#RemoteOnboarding#CloudHR#FutureOfWork#OraclePartner#TalentManagement#EmployeeSuccess#Avion Technology

0 notes

Text

How to Manage Payroll Efficiently Using QB Online

Managing payroll can be one of the most time-consuming and complex tasks for business owners. From calculating wages and tax withholdings to filing reports and ensuring compliance, there are many moving parts that need to be handled accurately. Fortunately, QuickBooks Online (QB Online) simplifies this process with powerful, user-friendly payroll features.

Whether you're new to QuickBooks or looking to improve your current system, this guide will walk you through how to manage payroll efficiently using QB Online.

Why Payroll Management Matters

Payroll Is More Than Just Paying Employees

Effective payroll management isn’t just about issuing paychecks—it’s about staying compliant with tax laws, keeping employees satisfied, and maintaining accurate financial records. Mistakes in payroll can lead to legal issues, unhappy employees, and even penalties from the IRS.

The Cost of Payroll Errors

From overpaying taxes to missing deadlines, payroll errors can be costly. A system like QB Online minimizes these risks by automating many aspects of the process and keeping you compliant with federal, state, and local regulations.

Getting Started with QB Online Payroll

Choosing the Right Payroll Plan

QuickBooks offers three payroll plans:

Core: For small teams needing basic payroll and tax filing

Premium: Includes same-day direct deposit and HR support

Elite: Adds tax penalty protection and expert setup assistance

Choose the plan that fits your business size and needs. You can always upgrade as your team grows.

Setting Up Payroll in QB Online

Here’s how to get started:

Step 1: Add Company Information

Input your business’s legal name, address, and Employer Identification Number (EIN). This ensures your payroll tax forms are accurate and complete.

Step 2: Add Employees

You’ll need each employee’s name, address, Social Security number, pay rate, and tax withholding information. QB Online allows you to invite employees to fill out their own information digitally, saving time and reducing errors.

Step 3: Set Up Pay Schedules

You can set up multiple pay schedules (e.g., weekly, bi-weekly) to match your payroll needs. Each employee can be assigned to a different schedule if needed.

Step 4: Connect Bank Accounts

Link your business bank account to fund payroll and handle tax payments automatically.

Running Payroll with QB Online

How to Run Payroll in Just a Few Clicks

Once setup is complete, running payroll is straightforward:

Go to the Payroll Dashboard

Select Run Payroll

Enter Hours Worked or Confirm Salaries

Review Paychecks

Submit Payroll

The system calculates everything for you, including overtime, deductions, and employer contributions.

Direct Deposit and Pay Stubs

QB Online offers same-day or next-day direct deposit depending on your plan. Employees receive digital pay stubs via email or their employee portal, keeping the process paperless and efficient.

Automating Payroll Tasks

Automated Tax Filing and Payments

QB Online automatically calculates, files, and pays your federal and state payroll taxes. This includes:

Federal income tax

Social Security and Medicare

State income tax and unemployment insurance

You’ll receive reminders and confirmations to stay on top of compliance.

Year-End Tasks Simplified

At the end of the year, QB Online generates and files W-2s and 1099s, and provides employees with access to their tax forms digitally. This saves hours of manual work and ensures accuracy.

Advanced Payroll Features for Greater Efficiency

Time Tracking Integration

If you use tools like TSheets (now QuickBooks Time), you can sync employee time data directly into payroll. This eliminates the need to manually enter hours and ensures accurate pay.

Benefits Management

QB Online allows integration with benefits providers so you can manage health insurance, retirement plans, and other employee perks directly from your payroll dashboard.

HR Tools and Compliance

Higher-tier QB Payroll plans include access to HR advisors, customizable employee handbooks, and tools to stay compliant with labor laws.

Best Practices for Payroll Efficiency

Keep Employee Data Up to Date

Encourage employees to use the self-service portal to update their information. This reduces administrative overhead and ensures accurate records.

Schedule Payroll Reminders

Even with automation, it’s wise to set up calendar reminders for payroll processing dates, tax deadlines, and compliance tasks.

Audit Regularly

Review your payroll reports monthly to ensure accuracy. Look for discrepancies in wages, tax withholdings, or hours worked. Catching mistakes early prevents larger problems down the road.

Troubleshooting and Support

When Things Go Wrong

If payroll errors occur, QB Online provides a guided correction process. For instance, you can cancel a payroll run or adjust an employee’s tax setup.

Accessing Expert Help

If you're unsure about tax issues or complex payroll situations, QuickBooks Payroll offers access to certified payroll experts and even tax protection guarantees with the Elite plan.

Conclusion

Managing payroll doesn’t have to be a burden. With QuickBooks Online, you gain a reliable, streamlined system that handles the hard parts—so you can focus on growing your business and supporting your team.

By taking advantage of its powerful automation, real-time tracking, and compliance tools, you can run payroll with confidence and efficiency. Whether you're paying one employee or a growing team, QB Online provides the scalability and reliability modern businesses need.

1 note

·

View note

Text

“High-Performance RDP for Enterprise Use: Inside RHosting’s Capabilities”

In the enterprise world, remote desktop access isn’t just a convenience — it’s a mission-critical capability. Performance, security, and scalability must be non-negotiable. Traditional RDP setups often fall short when faced with real-time workloads, distributed teams, and high-security demands.

Enter RHosting — a next-generation RDP platform designed specifically to meet the needs of modern enterprises. With cloud-optimized infrastructure, enterprise-grade security, and advanced customization, RHosting delivers high-performance remote access at scale.

Here’s a deep dive into the capabilities that make RHosting ideal for enterprise environments.

⚡ 1. Optimized for Speed and Performance

Enterprise users often run resource-heavy applications — from ERPs and CRMs to analytics dashboards and virtual design tools. RHosting is optimized to handle these intensive workloads without lag or downtime.

Low-latency connections, even over long distances

Load balancing and autoscaling for peak efficiency

Seamless access to Windows desktops and apps on-demand

GPU support for graphic-intensive workloads (optional tiers)

Whether your team is working from a remote branch office or across continents, RHosting ensures a consistent, high-speed user experience.

🛡️ 2. Enterprise-Grade Security Architecture

Security is a top priority for any business. RHosting offers a zero-trust-ready environment with multiple layers of protection:

End-to-end encryption (AES 256-bit)

Multi-factor authentication (MFA)

IP whitelisting & geofencing

Role-based access control (RBAC)

No open ports, no public RDP exposure

Activity logging and session monitoring also help your IT teams stay compliant and audit-ready.

🧩 3. Custom Configuration for Any Use Case

Every enterprise has different needs. RHosting provides flexible configuration options to fit your organization’s workflows:

Isolated server environments for teams, departments, or clients

Custom app publishing — provide access only to Tally, AutoCAD, QuickBooks, etc.

Folder-level permission management

SSO and Active Directory integration (on request)

Our platform supports fully managed or self-managed deployment models — giving you the control you need.

📊 4. Centralized Administration with Granular Controls

Managing large teams doesn’t have to mean IT overload. With RHosting’s intuitive admin portal, your IT department can:

Create and manage users in bulk

Assign or revoke access instantly

Monitor usage, generate reports, and set usage limits

Push updates or roll back configurations without disruption

It’s enterprise-level control without enterprise-level complexity.

🌐 5. Global Availability with Cloud-First Infrastructure

RHosting is hosted on high-speed data centers strategically located worldwide, allowing global teams to connect to the nearest server for optimal performance.

Geo-optimized routing

High availability architecture

Disaster recovery options and backups

24/7 infrastructure monitoring

Whether you’re operating in the U.S., Europe, India, or across multiple continents — RHosting keeps your business connected.

🚀 6. Seamless Scaling for Growing Teams

As your business grows, RHosting scales with you — without new hardware, license limits, or long onboarding cycles.

Add new users or environments in minutes

Easily scale resources (RAM, CPU, storage) as demand increases

Monthly billing with transparent enterprise pricing

✅ Built for the Demands of the Modern Enterprise

RHosting delivers more than just remote access — it’s a platform for agile, secure, and scalable work environments. With a laser focus on performance and security, RHosting empowers enterprises to support remote operations without compromise.

0 notes

Text

Top Business Startup Tips to Succeed from Gaurav Mohindra

Launching a startup is a bold move. Gaurav Mohindra, a seasoned entrepreneur and business strategist, is sharing his experience in the startup business growth.

Let’s explore top startup strategies for long-term success.

1. Start with a Problem, Not Just an Idea

Solving real word problem is very important to succeed in the business. This is the reason of failure of too many startups.

Top Advice:

Identify pain points people face daily.

Validate that the problem is urgent and widespread.

Test if your solution makes life significantly easier or better.

2. Conduct Market Research Before You Build

Understanding your market is non-negotiable. Experts emphasizes that research saves time, money, and frustration.

3. Build a Minimum Viable Product (MVP)

An MVP helps you launch fast, get feedback, and avoid over-investing in features users don’t need.

Steps to Create an MVP:

Identify core features that solve the main problem.

Build a basic version—webpage, demo, or app prototype.

Launch to a small test group for real feedback.

Remember: Done is better than perfect.

4. Know Your Numbers

If you don’t know your numbers, you don’t know your business.

Startup Metrics to Track:

Burn rate and runway

Customer acquisition cost (CAC)

Lifetime value (LTV)

Gross margin and profit forecast

Tools to Use: QuickBooks, Stripe, Google Analytics, ProfitWell

5. Master the Art of Storytelling

Your startup's story is more powerful than you think. To build trust you must have quality of storytelling.

How to Craft Your Brand Story:

Define your "why"—why did you start this business?

Share your founder journey with authenticity.

Highlight the transformation your product offers.

Tip: Use storytelling on your pitch deck, website, and social media.

6. Build a Strong Network Early

One of the most underrated startup tips is leveraging relationships.

Networking Tactics That Work:

Attend pitch nights and industry events

Join entrepreneur communities (online/offline)

Connect with mentors and thought leaders

Collaborate with complementary startups

Quote from Gaurav Mohindra: “Your network can be your fastest route to funding, feedback, or your next co-founder.”

7. Be Strategic About Funding

Raising capital isn’t always the answer. Experts recommend evaluating your business stage and funding readiness before seeking investors.

Funding Options to Explore:

Bootstrapping to maintain control

Angel investors for early-stage guidance

Crowdfunding to validate your product

Venture Capital (VC) when scaling fast

Tip: Always align your funding strategy with your growth goals and values.

8. Assemble a Purpose-Driven Team

Hiring the right team can make or break your startup.

Hiring Criteria Suggested by experts

Passion for the mission

Willingness to learn and adapt

Complementary skillsets (e.g., tech, sales, marketing)

Cultural alignment and startup mindset

Bonus Tip: In early stages, hire generalists who can wear multiple hats.

9. Market Early, Not Just After Launch

Many startups wait too long to start building an audience. Gaurav insists on early marketing—even pre-launch.

Early-Stage Marketing Checklist:

Create a landing page with an email signup

Share your journey on LinkedIn or Instagram

Use content marketing to build SEO traction

Engage early adopters and beta testers

Tools: Mailchimp, Canva, Buffer, SEMrush

10. Embrace Agility and Feedback Loops

Startups that succeed adapt fast. Gaurav’s core philosophy centers around continuous iteration.

Agile Success Tips:

Use tools like Trello, Asana, or Notion to manage sprints

Hold weekly feedback and retrospectives

Test assumptions regularly

Kill or pivot ideas that don’t perform

Final Thought: Progress beats perfection. Learn, adapt, evolve.

Bonus: Gaurav Mohindra’s Entrepreneurial Mantras

Here are five short yet powerful principles expert follows and recommends:

“Solve before you scale.”

“People over products.”

“Data drives decisions, not ego.”

“Start lean, scale smart.”

“Never stop learning—humility wins.”

Conclusion: Your Roadmap to Startup Success

Success doesn’t happen overnight. It comes from smart planning, constant learning, and staying true to your mission. For Personalized startup consulting Gaurav Mohindra is always ready for you.

Originally Posted: https://gauravmohindrachicago.com/top-business-startup-tips/

1 note

·

View note

Text

The Power of Integration: Connecting Your Business for Success

In today’s fast-paced digital landscape, business success is no longer just about having a great product or service. It’s about how well your systems, data, and teams connect and communicate. Integration has emerged as the cornerstone of digital transformation, helping organizations streamline processes, improve customer experiences, and drive sustainable growth.

Whether you're a startup scaling quickly or a large enterprise trying to modernize legacy systems, the key to staying competitive lies in integrating your business systems effectively. And when it comes to powerful integrations, Salesforce stands at the forefront. For companies looking to take full advantage of this powerful CRM platform, working with a Salesforce consultant in New York can make all the difference.

Why Integration Matters More Than Ever

Imagine your marketing team working in one tool, your sales team using another, and your customer service team using yet another platform. Without integration, each department becomes a silo, operating on incomplete or inconsistent data. This leads to inefficiencies, miscommunication, and missed opportunities.

Integration ensures that all your business systems — CRM, ERP, marketing automation, e-commerce, analytics, and customer support — work together seamlessly. This not only reduces manual work and errors but also gives your team a 360-degree view of your customers and operations.

When properly executed, integration results in:

Improved efficiency through automation

Better customer experiences through personalized engagement

More informed decision-making with real-time data

Cost savings by reducing redundant tools and processes

Salesforce: The Backbone of Integrated Business Systems

Salesforce isn’t just a CRM; it's an entire ecosystem designed to help businesses manage every touchpoint of the customer journey. From sales and marketing to service and commerce, Salesforce connects every part of your organization on a single platform.

But to truly unlock its potential, Salesforce must be customized and integrated to fit your unique business needs. That’s where working with a Salesforce consulting partner in New York becomes crucial.

Why Work with a Salesforce Consultant in New York?

New York is home to some of the most dynamic and diverse businesses in the world — from finance and retail to media and tech. With such a competitive and fast-paced environment, companies need more than off-the-shelf solutions. They need strategic partners who understand the nuances of their industry and can tailor solutions for real-world results.

Here’s why hiring a Salesforce consultant in New York is a smart move:

1. Local Expertise with Global Vision

A Salesforce consulting partner in New York understands the local business landscape, regulations, and customer expectations. Whether you're a financial firm in Manhattan or a retail startup in Brooklyn, these consultants bring both domain expertise and global Salesforce capabilities.

2. Customized Integrations

Every business is different. An experienced Salesforce developer in New York can build custom integrations between Salesforce and your existing tools — whether it’s QuickBooks, Shopify, HubSpot, or a legacy ERP. These integrations eliminate manual data entry and create real-time data sync across platforms.

3. Scalable Solutions

As your business grows, so do your technology needs. A Salesforce consultant helps you design scalable systems that grow with you, avoiding the costly process of reimplementation later on.

4. Faster Implementation

Thanks to their expertise, Salesforce consultants in New York can accelerate the setup and configuration process. They’ll help you avoid common pitfalls, saving you time and money in the long run.

5. Ongoing Support and Optimization

Integration isn't a one-time project — it's an ongoing journey. The best Salesforce partners offer continued support, training, and optimization to ensure you're getting the most from your investment.

Real-World Example: Retail Company Integrates Salesforce for Seamless Customer Experience

Consider a New York-based retail brand with both online and brick-and-mortar stores. Before integration, they managed their inventory in one system, customer emails in another, and sales data in spreadsheets. The lack of synchronization led to stock discrepancies, delayed responses to customer inquiries, and missed sales opportunities.

After partnering with a Salesforce consulting partner in New York, they integrated all systems into a single Salesforce platform. Now, customer service reps can instantly see a customer’s purchase history, stock availability, and shipping status — all in one place. Marketing can send targeted offers based on recent purchases, and executives have real-time dashboards for strategic decision-making.

The result? Increased customer satisfaction, improved team productivity, and a measurable increase in revenue.

Popular Integration Use Cases for Salesforce

Here are a few common integration scenarios that businesses pursue with the help of Salesforce consultants in New York:

1. Marketing Automation

Integrate tools like Mailchimp, Marketo, or Pardot with Salesforce to sync lead data, track campaign performance, and personalize customer journeys.

2. Accounting and Finance

Link Salesforce with accounting software like QuickBooks or Xero to streamline invoicing, payment tracking, and financial reporting.

3. E-commerce Platforms

For retailers, connecting platforms like Shopify, Magento, or WooCommerce with Salesforce helps unify customer data, streamline order processing, and enhance personalization.

4. Customer Service Tools

Integrating systems like Zendesk or ServiceNow into Salesforce’s Service Cloud can improve issue resolution times and enhance customer satisfaction.

5. Custom App Development

A skilled Salesforce developer in New York can build custom APIs and apps to support unique business requirements and workflows, creating a seamless digital experience.

Choosing the Right Salesforce Consulting Partner in New York

Not all Salesforce consultants are created equal. Here’s what to look for when choosing your integration partner:

Certified Expertise: Ensure they hold relevant Salesforce certifications and have experience with similar integration projects.

Proven Track Record: Look for case studies, testimonials, or references that show successful implementations.

Strategic Mindset: Beyond technical skills, the right partner will align solutions with your business goals.

Local Presence: A local team provides better communication, faster response times, and a deeper understanding of regional business dynamics.

Final Thoughts: Integrated Businesses Are Future-Ready

In an age where data is king and customer expectations are higher than ever, businesses that operate in silos risk falling behind. Integration isn't just a tech upgrade — it's a strategic imperative that connects your business for success.

Whether you're aiming to automate workflows, improve customer relationships, or gain deeper insights, Salesforce provides a powerful foundation. But to harness its full potential, you need the right guidance and technical support.

Partnering with a Salesforce consulting partner in New York ensures your systems are not only connected but also optimized for peak performance. With the help of experienced Salesforce consultants in New York, your business can unlock new efficiencies, deliver exceptional customer experiences, and set the stage for long-term growth.

Ready to integrate and innovate? Start your journey today with a trusted Salesforce consultant in New York who can turn your business vision into a connected reality.

#salesforce consultant in new york#salesforce consulting in new york#salesforce consulting partner in new york#salesforce consultants in new york#salesforce developer in new york#The Power of Integration: Connecting Your Business for Success

0 notes

Text

The Ultimate Guide to Choosing the Right Workflow Apps for Your Business

Efficient workflow management is essential for business growth and productivity. The right workflow apps can automate tasks, reduce manual errors, and streamline operations, making them a critical part of any successful business strategy. Cflow is one such app that stands out for its powerful no-code automation capabilities, making it an excellent choice for businesses of all sizes.

Why Your Business Needs Workflow Apps

Workflow apps help automate repetitive tasks, improve collaboration, and provide real-time insights into business processes. Here’s why they are essential:

Improved Efficiency: Automate routine tasks, freeing up time for high-value work.

Better Collaboration: Centralize task management and communication for seamless teamwork.

Cost Savings: Reduce manual errors and streamline operations, leading to lower operational costs.

Scalability: Easily scale your processes as your business grows.

Real-Time Insights: Get detailed reports and analytics to identify bottlenecks and improve decision-making.

Key Features to Look for in a Workflow App

When choosing the right workflow app for your business, consider these essential features:

No-Code Automation: Tools like Cflow offer no-code automation, allowing you to create complex workflows without technical skills. This is perfect for businesses looking for agility without relying heavily on IT support.

Integration Capabilities: Your workflow app should integrate seamlessly with your existing tools like CRM, ERP, and communication platforms. This ensures a smooth flow of data across systems.

Customization and Flexibility: Look for apps that allow you to customize workflows to match your business processes. Flexible workflows are essential for adapting to changing business needs.

Scalability: Choose a tool that can grow with your business, supporting more users, processes, and data without compromising performance.

Analytics and Reporting: Detailed insights into process performance are critical for continuous improvement. This helps identify bottlenecks and optimize workflows for maximum efficiency.

Security and Compliance: Ensure the app adheres to industry security standards to protect sensitive business data.

Top Workflow Apps for Businesses in 2025

Here are some of the best workflow apps to consider:

Cflow: Known for its powerful no-code automation, flexible workflow designs, and robust analytics. Ideal for businesses of all sizes.

Trello: Great for task management and collaboration with a simple, card-based interface.

Asana: Popular for project management with advanced task tracking and team collaboration features.

Monday.com: Known for its highly customizable workflows and integrations.

Zapier: Ideal for small businesses looking for easy, no-code integrations.

Why Cflow is a Smart Choice for Your Business

Cflow stands out as a reliable choice for businesses looking for flexibility and ease of use. It offers:

No-Code Automation: Simplifies process automation without technical complexity.

Powerful Integrations: Connects seamlessly with popular tools like Slack, Salesforce, and QuickBooks.

Customizable Workflows: Easily adapt workflows as your business evolves.

Scalable Architecture: Grows with your business without compromising performance.

Detailed Reporting: Provides actionable insights to optimize workflows.

youtube

Conclusion

Choosing the right workflow app is a critical decision that can significantly impact your business efficiency and growth. With the right app, you can streamline operations, reduce costs, and improve overall productivity. Cflow, with its no-code automation, powerful integrations, and scalable architecture, is an excellent choice for businesses looking to stay ahead in today’s competitive market.

SITES WE SUPPORT

Smart Screen AI - WordPress

SOCIAL LINKS Facebook Twitter LinkedIn

0 notes

Text

How to Print and Mail Cheques from QuickBooks and Other Accounting Software

Even in 2025, cheques remain essential for many businesses. From vendor payments to payroll processing, printed cheques offer control, traceability, and compliance. While digital payments dominate in many sectors, printing and mailing cheques through accounting software like QuickBooks, Xero, and Sage is still a preferred option for thousands of companies.

In this comprehensive guide, you’ll learn how to securely print and mail cheques from QuickBooks and other accounting software—automatically, efficiently, and in compliance with today’s financial regulations.

Why Businesses Still Use Printed Cheques in 2025

Despite the rise of ACH and wire transfers, printed cheques continue to play a role due to:

Vendor preferences in certain industries.

Record-keeping requirements for auditing and reconciliation.

Security controls offered by physical documents.

Cross-border transactions where electronic systems may lag.

Advantages of Automated Cheque Printing and Mailing

AdvantageDescriptionSaves TimeNo manual printing, signing, or stuffing envelopes.Improves SecurityMICR-encoded, fraud-resistant checks with audit trails.Enhances WorkflowSyncs directly with your accounting system.Reduces CostsNo need for in-house printers, supplies, or postage.Offers Mailing FlexibilitySend via USPS, FedEx, or Canada Post.

How Cheque Printing & Mailing Works from QuickBooks

Step-by-Step for QuickBooks Online Users

Connect to a Cheque Mailing Service

Use integrations like Checkeeper, Melio, or Deluxe eChecks.

Enter Bill or Payment Info

Record the vendor payment like any other transaction.

Choose “Print Later” Option

Flag the cheque for batch processing.

Log into Your Cheque Mail Service

Import the pending cheques.

Select Cheque Style and Template

Use company-branded checks with MICR encoding.

Confirm Mailing Preferences

Select envelope type, delivery method, and speed.

Process and Track

Monitor mailing status and delivery confirmations.

Using Checkeeper: A QuickBooks-Integrated Solution

Checkeeper is a popular tool for QuickBooks users due to:

Full QuickBooks Online and Desktop integration.

Unlimited check printing and cloud-based templates.

USPS mailing with delivery tracking.

Same-day processing.

Printing Cheques from QuickBooks Desktop

Install Compatible Printer with MICR Toner

Insert Blank Cheque Stock

Go to File > Print Forms > Cheques

Select Bank Account and Cheques

Preview and Print

For mailing, integrate with services like PrintBoss, which automates batching and postal fulfillment.

Mailing Cheques from Other Accounting Software

1. Xero

Integrate with Plooto or Checkeeper.

Export payment details or sync directly via API.

Set up cheque layouts and print/mail options.

2. Sage

Use Sage-integrated tools like Deluxe or Checkflo.

Enable multi-user access for approvals and print queues.

3. FreshBooks

FreshBooks doesn’t have native cheque support but works via Zapier and tools like VersaCheck or Checkeeper.

Features to Look for in Cheque Printing Software

FeatureBenefitMICR EncodingMeets bank processing standards.Cloud Sync with Accounting SoftwareEnsures accurate data flow.USPS/Canada Post SupportOffers mail tracking and delivery options.Custom TemplatesAllows brand consistency.Batch PrintingSpeeds up bulk operations.Two-Factor AuthenticationAdds security for sensitive payments.

Security and Compliance Tips

Use Secure Printers or Cloud Providers

Prevent unauthorized access with role-based controls.

Enable Multi-User Approval Workflows

Require sign-off from finance or management.

Encrypt All Transactions

Ensure data in transit and storage is secured.

Store Cheque Images and Logs

Useful for audits and dispute resolution.

Comply with NACHA & CRA Standards

Meet U.S. and Canadian cheque compliance laws.

Cost Considerations

Cost ItemTypical CostBlank Cheque Stock$25–$60 per 500 checksMICR Toner Cartridges$80–$150 eachMailing Service Fees$1.50–$3.50 per chequeSoftware Subscription$10–$50/month depending on features

Using an all-in-one provider is often more affordable than managing in-house.

Best Practices for Efficiency

Automate recurring payments like rent or contractor payroll.

Outsource high-volume payments to print-and-mail vendors.

Centralize cheque logs for internal control and audit readiness.

Add QR codes for recipients to scan and confirm deposit instructions.

Cheque Printing API Integrations

For developers and finance teams:

Lob API – Ideal for enterprise cheque workflows.

Checkeeper API – Simple integration with CRMs and billing tools.

Melio API – Focused on bill pay and expense management.

These APIs enable fully automated cheque issuance from custom applications.

Conclusion

In 2025, printing and mailing cheques from QuickBooks and other accounting software is easier, faster, and more secure than ever. Whether you're a small business paying local vendors or a large organization handling payroll, leveraging cheque automation tools saves time, reduces errors, and ensures compliance.

By selecting the right platform, integrating with your accounting software, and following best practices, you can modernize your cheque workflow while keeping the trust and flexibility that paper payments provide.

youtube

SITES WE SUPPORT

Automated Postal APIs – Wix

0 notes

Text

Top 10 Features to Look for in Construction Scheduling Software

Construction projects depend on scheduling, which forms their foundation for success. When deadlines are missed, costs will increase and client satisfaction will decline, leading to even more serious consequences like the loss of future business opportunities. Every contractor must make selecting construction scheduling software for small business a mission-critical decision.

How can you determine which scheduling tool is appropriate for your needs when dozens of options exist?

From solo contractors handling multiple projects to growing companies managing several dozen projects.

Top 10 Features To Find The Best Scheduling Software

These top 10 features should be your priority when selecting a project management tool for efficient contractor scheduling and project execution.

1. Drag-and-Drop Scheduling Interface

Construction businesses operate under tight time constraints where inefficient software leads to monetary losses. The drag-and-drop calendar interface enables users to move tasks and reassign resources while adjusting timelines without needing to navigate complex menus or write code.

Look For:

Real-time updates

Intuitive visuals (Gantt charts, color-coded calendars)

Automatic conflict alerts

This feature provides fast-paced teams with the ability to make immediate adjustments when needed. Managing construction schedules becomes much easier using this tool because it handles unexpected variables such as weather interruptions and subcontractor scheduling conflicts.

2. Resource Allocation and Management

Scheduling requires understanding who performs tasks and where they happen besides knowing when they take place. Resource management coordinates crews and equipment with materials to make sure they reach their destinations at scheduled times.

Look For:

Crew assignment and availability tracking

Equipment usage schedules

Material delivery timelines

Efficient resource allocation prevents double-bookings and idle time resulting in reduced delays and improved profit margins.

3. Mobile Access and Field Updates

Work happens at the jobsite so your software should follow your team wherever they go. Contractors and field crews can view and update their schedules instantly on their smartphones and tablets thanks to mobile functionality.

Look For:

Mobile-friendly dashboards

Real-time notifications

Offline access for remote job sites

The scheduling software feature that facilitates field-to-office communication remains underappreciated yet plays a vital role in minimizing misunderstandings and promoting team accountability.

4. Integration With Other Project Management Tools

Successful scheduling software requires compatibility with other systems to function properly. When you sync your scheduling system with budgeting, invoicing, or blueprint apps it produces a comprehensive management framework for every element of construction projects.

Look For:

Software solutions integrate with construction management tools such as 123worx, Procore, QuickBooks and Buildertrend

• API access for custom connections

• Seamless import/export options

Imagine creating a central command center for all your business operations which eliminates the need to switch between apps and maximizes productivity.

5. Collaboration & Permission Controls

Construction projects demand coordination between many different individuals including subcontractors and clients as well as suppliers and inspectors. Your team can work together through a robust scheduling platform while maintaining full control over operations.

Look For:

Role-based access and permissions

Shared calendars for external collaborators

Commenting and change-tracking features

Through structured collaboration all parties receive transparent information which cuts down on conflicts and keeps everyone aligned both physically and conceptually.

7. Automated Alerts and Notifications

Construction schedules are ever-evolving documents with adjustments that may occur every day or even every hour. Team members risk arriving at incorrect job sites and missing crucial deadlines or encountering work disruptions with other trades if they do not receive timely updates.

Key Benefits of Automated Alerts:

The system provides instant alerts when tasks are completed and when there are any changes to the schedule.

Alerts for overdue assignments or milestone deadlines

Field teams and subcontractors receive daily schedule updates through summaries.

Contractors can eliminate the need for manual follow-ups with teams or sending multiple texts every morning. The software handles all the demanding tasks so you can run your operation effectively without needing to micromanage.

Pro Tip: Systems that enable custom triggers such as “Notify when delivery is 24 hours out” or “Send reminder if task not started after X hours” eliminate the guesswork in crew and material management.

8. Weather Impact Tools and Adjustments

Construction projects face weather delays as a normal occurrence but many project schedules fail to include provisions for them until problems arise. Advanced scheduling software includes weather forecasting capabilities and provides recommendations for schedule changes.

Features to Look For:

The system delivers live weather notifications according to the construction site location.

• Automatic rescheduling of weather-sensitive tasks

• Forecast dashboards for planning weeks in advance

Outdoor contractors, including roofers and concrete workers, find this feature particularly essential for their operations. Weather-integrated scheduling maintains realistic timeframes while preventing crews from making futile trips.

9. Cost-to-Time Tracking

Time is money—literally. Projects become less profitable when labor costs increase because tasks exceed their scheduled time limits. Cost-to-time tracking provides precise visibility into the financial effects of time delays on your budget.

What It Tracks:

Labor hours vs. budgeted time

Overtime trends and job inefficiencies

Specific tasks or trades cause cost overruns.

This feature links your project timelines and financial tracking to illustrate your profit-making areas and where losses occur. Post-project reviews find significant value in this feature as it enables creation of bids that are both more competitive and accurate moving forward.

10. Client Portal or Viewer Access

Clients are now demanding direct access to project timelines to avoid repetitive phone calls and emails. Clients receive a clean read-only view of the schedule via a client portal to track progress, view changes, and remain updated.

Why Clients Love It:

Reduces uncertainty and builds trust

Makes contractors appear more organized and tech-savvy

Improves communication without adding workload

Offering clients optional access demonstrates your brand as professional while setting you apart from competitors through transparency and modernity.

Enhanced Wrap-Up

It is evident that construction scheduling software differs greatly in terms of quality and functionality. To select the best option requires evaluation of features beyond standard calendar capabilities.

Drag-and-drop scheduling

Resource and crew management

Mobile field access

System integrations

Collaboration and permissions

Automated alerts

Weather forecasting

Time-cost analysis

Client visibility tools

For both solo contractors and those managing multiple crews proper investment in project management tools has become critical for achieving sustained growth and operational efficiency.

Choose Software That Scales With You

The tool you pick for residential remodels or commercial builds must help your business expand without hindering it.

Start with your current needs, but think ahead: Will your business expansion be supported by the software through its capacity for additional users and projects alongside more integrations.

0 notes

Text

Aurionpro Payments API Integration by Infinity Webinfo Pvt Ltd

In today's fast-paced digital landscape, businesses are constantly looking for solutions that streamline their payment systems, enhance customer experience, and ensure smooth transactions. This is where Aurionpro Payments API integration comes into play. Partnering with Infinity Webinfo Pvt Ltd, a renowned website developer, this integration offers a state-of-the-art solution that enables seamless bill payments and more.

Understanding the Need for Effective Bill Payment Software

As businesses grow and expand their online presence, efficient bill payment software becomes crucial. Traditional methods of bill payment, often reliant on manual processes, are becoming increasingly outdated. Customers demand faster, secure, and convenient ways to pay their bills online, and businesses need a reliable system to keep up with these expectations.

Aurionpro Payments API, a leading name in payment technology, offers a robust solution designed to integrate easily with websites, mobile apps, and business systems. The seamless integration of this API into existing systems can automate and optimize the entire billing process, significantly reducing manual intervention and improving transaction accuracy.

The Role of Infinity Webinfo Pvt Ltd in Enhancing Payment Solutions

Infinity Webinfo Pvt Ltd, a leading website developer, has taken a giant leap forward in offering integrated solutions for bill payment systems by incorporating Aurionpro Payments API. With a focus on innovative web development, the company ensures that businesses can integrate and implement Aurionpro Payments technology into their platforms without any hassle.

By choosing Infinity Webinfo Pvt Ltd as their development partner, businesses can tap into a well-rounded service offering. The team at Infinity Webinfo is adept at designing user-friendly websites that seamlessly connect with payment systems, making bill payments smoother for users. Whether it's a one-time bill payment or recurring payments, their expertise guarantees the creation of a custom-tailored solution that aligns with each business's specific needs.

Key Features of Aurionpro Payments API Integrations

Modular Integration Options: The platform supports various integration methods, such as H2H APIs, widgets, and SDKs, enabling businesses to select the integration path that aligns with their technical capabilities and business requirements .

Low-Code and No-Code Capabilities: Aurionpro Payments provides low-code and no-code tools, facilitating rapid deployment and customization without extensive coding expertise.

White-Label Solutions: Businesses can leverage white-label solutions to offer branded payment experiences to their customers, enhancing brand consistency and customer trust.

Seamless QuickBooks Integration: The platform integrates with QuickBooks, allowing for automated synchronization of financial data, reducing manual data entry and minimizing errors .

Partner and Reseller Management: Aurionpro Payments enables efficient onboarding and management of partner and reseller networks, streamlining operations and expanding business reach .

Frictionless Checkout: The platform offers a seamless checkout experience, minimizing user interactions and enhancing customer satisfaction

Benefits of Integrating Aurionpro Payments API

Enhanced User Experience: Integrating the Aurionpro Payments API allows customers to make payments quickly and easily. With minimal clicks, customers can pay their bills without friction. This smooth process leads to higher customer satisfaction and retention.

Security: With the growing concern around online fraud and data breaches, Aurionpro Payments API ensures top-notch security for every transaction. It employs advanced encryption protocols to protect sensitive financial data and offers fraud prevention measures.

Scalability: The integration is designed to scale with the business, allowing companies to grow without worrying about payment bottlenecks. Businesses of any size can benefit from the API’s flexible infrastructure.

Customization: The API can be fully customized to meet the specific needs of each business, whether it's managing subscriptions, processing invoices, or handling complex billing scenarios.

Comprehensive Reporting: With integrated payment systems, businesses gain access to comprehensive reporting tools that provide insights into transactions, payments, and overall billing efficiency.

The Future of Online Bill Payments with Infinity Webinfo Pvt Ltd

By offering Aurionpro Payments API integration, Infinity Webinfo Pvt Ltd is setting the stage for the future of online transactions and bill payments. The seamless connection between these two entities is a game-changer for businesses looking to provide hassle-free bill payment experiences. As more companies turn to digital solutions for their payment needs, this collaboration offers them a competitive edge.